Navigating the Green Gold Rush: Risks and Rewards of Investing in Net Zero

Latest estimates from the Climate Change Committee suggest that we will need to invest around £50bn every year to deliver Net Zero by 2050 in the UK. An evergreen investment theme coupled with large potential pools of funding will be music to the ears of PE dealmakers. The explosion of ‘ESG’ and ‘Impact’ investments – whether from a fund with a specific mandate or not - should, therefore, come as no surprise. Pressure is mounting on GPs to deploy capital in a market that achieves dual aims of investing dry powder while achieving sustainability targets.

For GPs, however, allocating funds to companies that participate in the Net Zero transition is no mean feat. Net Zero markets present unique structural challenges - herein lies both the risk and the opportunity. Recently, GRAPH has seen a number of so-called ‘ESG’ deals fail to reach completion – below we list some of the common challenges with investing in ‘Net Zero’ assets:

-

Paucity of attractive, scaled assets – high-quality platforms are rare, and often play in fragmented markets where a roll up is not straightforward

-

Rapid evolution of business models – the people-led, advisory services that are essential today may be largely technology-driven in the future. Investors must identify whether an asset has the agility to shift its model as a market matures

-

Over-reliance on single funding streams or regulations - if government funding, subsidies or regulations are delayed, redirected, or revoked entirely by the next government, considerable risk is exposed

-

Prevalence of ‘greenwashing’ - businesses are dressed up as ‘Environmental’ or ‘Impact’ investments, only to fail to demonstrate tangible environmental benefits during diligence

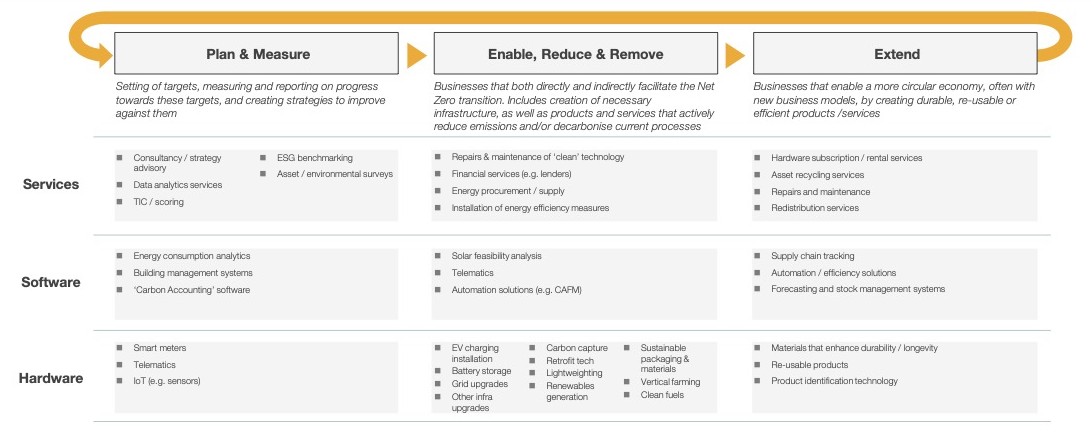

Backing the right horse in this shifting landscape is difficult. Nevertheless, we believe that by asking smart commercial questions, winners can be uncovered. A critical first step is to decipher the jargon that plagues this space by answering some fundamental questions about the business: What does it actually do? Who are its key customers? What are its routes to market? And finally, how, if in fact at all, is this business supporting the Net Zero transition? Our framework below should help to understand at what point the target participates…

Once an asset has been properly contextualised, there can be lots to be excited about - many Net Zero markets are ripe for disruption with considerable whitespace given the emergence and increasing maturity of products and services that address environmental concerns. To identify the opportunities, and to weigh up the risks, we’ve set out some key questions we often look to test during commercial due diligence:

-

Is market spend underpinned by regulation, compliance requirements or government funding and therefore non-discretionary? Is the business entirely reliant on a single funding mechanism or regulation?

-

In a market where an environmentally-friendly product or service is not yet widely adopted, is there a compelling reason to believe that said product or service will see a strong uptick in adoption in the next ~5 years? Has a recent catalyst altered the attractiveness of the market? Is this rationale equally as compelling in a more benign macro-environment (e.g. stable energy markets, lower interest rates and inflation)?

-

Does the product or service deliver a tangible environmental benefit? Does it also deliver cost savings vs. the traditional approach?

-

Does the target company have a clear point of differentiation which creates a defensible moat that makes its product or service difficult for (traditional) incumbents to replicate?

-

Is there a risk of disintermediation as the market matures? Alternatively, what is the likelihood that a product or service is brought in-house as it becomes more established?

-

In a market where multiple technology solutions are vying for dominance, is there compelling evidence that the target company’s solutions will win out? If not, is the target company sufficiently ‘agile and nimble’ that it can pivot as necessary?

GRAPH has completed multiple projects across sell-side and buy-side commercial due diligence, as well as customer referencing, strategy and market mapping exercises for businesses that participate in the Net Zero transition.

Example sub-sectors GRAPH has worked in span energy broking, fleet and vehicle optimisation, energy efficiency measures (e.g. solar, lighting, heat pumps, insulation), data analytics and ESG consultancy, real estate ESG benchmarking, building and energy management systems, and energy consumption data collection.

To find out more, or to request our ‘Net Zero Creds Pack’, get in touch with Matt Harrison (matt@graphstrategy.com).

Written by Matt Harrison